Mortgage Guide: Avoiding or Minimizing Prepayment Penalties

The last few Mortgage Guide posts have focused on prepayment penalties. We’ve discussed what they are, what prepayment privileges are, how the costs are calculated, and looked at an example of a prepayment penalty breakdown to illustrate how they’re calculated. In this post, we’ll discuss minimizing the mortgage prepayment penalties. After searching Windsor homes for sale, viewing houses for sale in Windsor, and finally closing on one, you do not want to incur more costs than you already have between the cost of the home and the cost of closing. When it comes to your mortgage, make sure you follow these tips to minimize or avoid prepayment penalties.

Make Full Use of your Prepayment Privileges

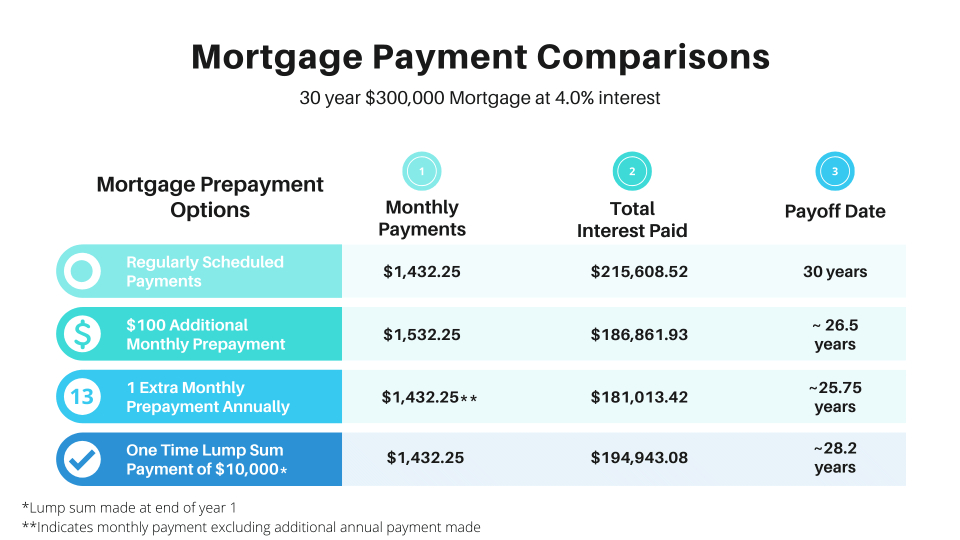

Make sure you are maximizing the use of your prepayment privileges every year. If you do go into the penalty phase in the future it will be based on a lower mortgage balance. Also consider making a lump-sum prepayment before you break your mortgage as some lenders may restrict this option as you get close to the date you break your contract.

Wait Until the End of your Term to Prepay

If your prepayment penalty is projected to be a large amount, think about waiting until the end of your term to prepay. After that, you can then make a lump-sum prepayment without penalty.

Port your Mortgage

If you’ve bought a new home, you can ask your lender about porting your mortgage. Essentially, you are asking to take your existing interest rate, terms and conditions with you to your new home. This can help you from breaking your mortgage contract and getting a new one, a situation which could incur the penalties.

Shop Around

When it comes time to renew your mortgage, don’t just go back to the same lender. Contact various different lenders and mortgage brokers to see if they are a better option or can offer you additional flexibility or prepayment privileges.

CLICK HERE, to get more information about mortgage prepayment privileges and penalties from the Financial Consumer Agency of Canada.

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, and Chatham, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!