If you’re planning to buy a home in Windsor, one of the first questions you’ll probably ask is: “How much do I need for a down payment?” It’s a smart question. Your down payment will determine how much you can afford, whether you’ll need mortgage insurance, and what your monthly payments will look like.

With Windsor’s housing market evolving quickly, it’s important to understand the rules, local price ranges, and the options available to you as a buyer. Here’s a complete 2025 guide tailored for Windsor homebuyers.

| Purchase price of your home | Minimum amount of down payment |

|---|---|

| $500,000 or less |

|

| $500,000 to $1.5 million |

|

| $1.5 million or more |

|

Examples of Windsor Down Payments:

A $400,000 home in Windsor → $20,000 minimum down payment (5%).

A $600,000 home in Windsor → $35,000 minimum down payment ($25,000 for the first $500,000 + $10,000 for the remaining $100,000).

A $1.5 million home in Windsor → $300,000 minimum down payment (20%).

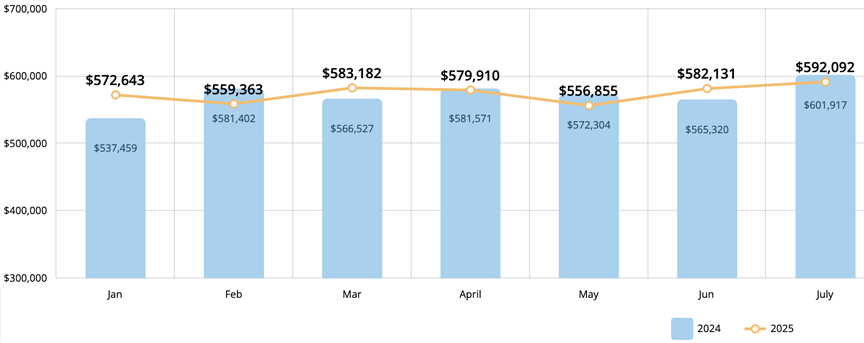

The average home price in Windsor-Essex in 2025 has ranged from a low of $556,855 in May to a high of $592,092 in July based on market reports from the Windsor-Essex County Association of Realtors® (WECAR). A full overview of the year can be seen below.

2025 Average Sale Price (Source: WECAR https://wecartech.com/wecfiles/stats_new/2025/jul/)

2025 Average Sale Price (Source: WECAR https://wecartech.com/wecfiles/stats_new/2025/jul/)

Buying your first home in Windsor? You may qualify for programs that help reduce upfront costs:

Ontario Land Transfer Tax Rebate – First-time homebuyers of an eligible home may be eligible for a refund of all or part of the tax. Learn More Here

Home Buyers’ Plan (HBP) – The Home Buyers' Plan (HBP) is a program that allows you to withdraw from your registered retirement savings plans (RRSPs) to buy or build a qualifying home. Learn More Here

Tax-Free First Home Savings Account (FHSA) – A FHSA is a registered plan which allows you to save to buy or build a qualifying first home tax-free up to certain limits. Learn More Here

If you’re not sure how much you’ll need for your specific situation, we can connect you with trusted mortgage specialists in Windsor and work with you to build a buying strategy that fits your goals. Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Kingsville, LaSalle, Harrow, and Chatham, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!